The Tax Court’s decision in the dispute between PT IR and the Directorate General of Taxes (DGT) provides an important lesson on the principle of causality in recognizing bank loan interest expenses for Corporate Income Tax (CIT) purposes. The ruling highlights the fine line between the use of borrowed funds for the taxpayer’s own business activities and their use to provide financing facilities to affiliated companies.

The dispute centered on a positive fiscal adjustment entirely related to bank loan interest expenses amounting to more than IDR 14.7 billion. The adjustment was made after the DGT found that the taxpayer obtained a bank credit facility but subsequently transferred part of the borrowed funds as loans to its affiliated company.

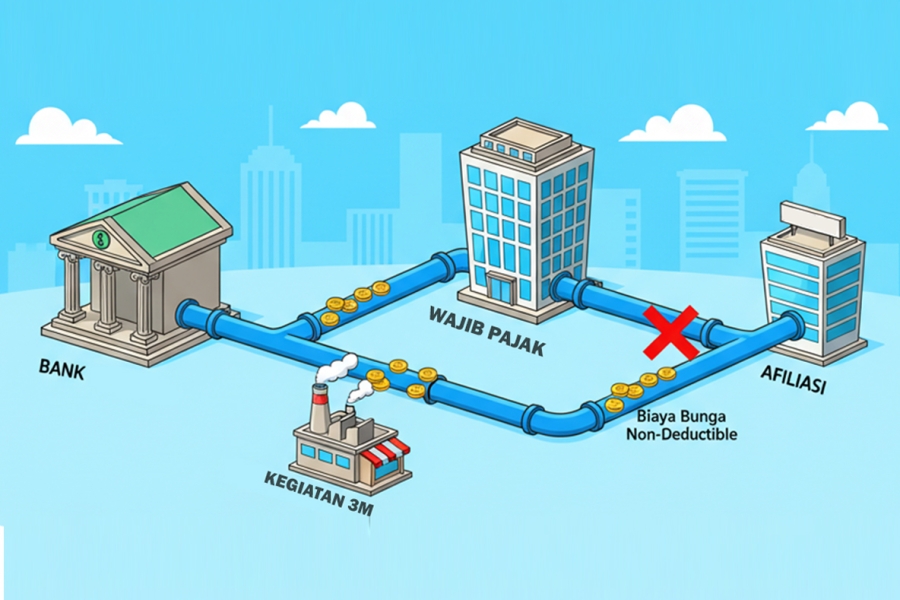

The DGT argued that only interest expenses directly related to the taxpayer’s own efforts to earn, collect, and maintain income (known as the 3M principle) can be deducted for tax purposes, as stipulated under Article 6 paragraph (1) of the Income Tax Law. Therefore, the portion of interest expenses attributable to funds re-lent to an affiliate was deemed non-deductible, as it did not meet the causality requirement under the 3M principle.

PT IR refuted the DGT’s argument, stating that the loan to its affiliate was subject to interest and duly reported as affiliated interest income. Consequently, if the DGT made a positive adjustment on the interest expense, it should also make a negative adjustment on the corresponding interest income earned from the re-lent funds. The Panel of Judges emphasized that the burden of proof lies entirely with the taxpayer.

In its consideration, the Court concluded that the taxpayer failed to demonstrate that the interest expense truly arose from a debt obligation used for its own 3M activities. However, the Court agreed with the taxpayer that the related interest income should also be correspondingly adjusted downward. Accordingly, the Court upheld the DGT’s adjustment only in part, specifically for the portion of bank loan interest related to funds passed on to the affiliate.

This decision reaffirms that taxpayers must be able to prove the allocation and use of borrowed funds. If bank loan proceeds obtained from third parties are transferred or re-lent to affiliated entities, the taxpayer should be prepared for potential fiscal adjustments, as interest expenses on the re-lent portion are highly likely to be deemed non-deductible.

The ruling serves as a strong reminder for companies performing treasury functions on behalf of affiliates using bank loan facilities. Without proper documentation and substantiation, such arrangements could lead to significant CIT corrections.